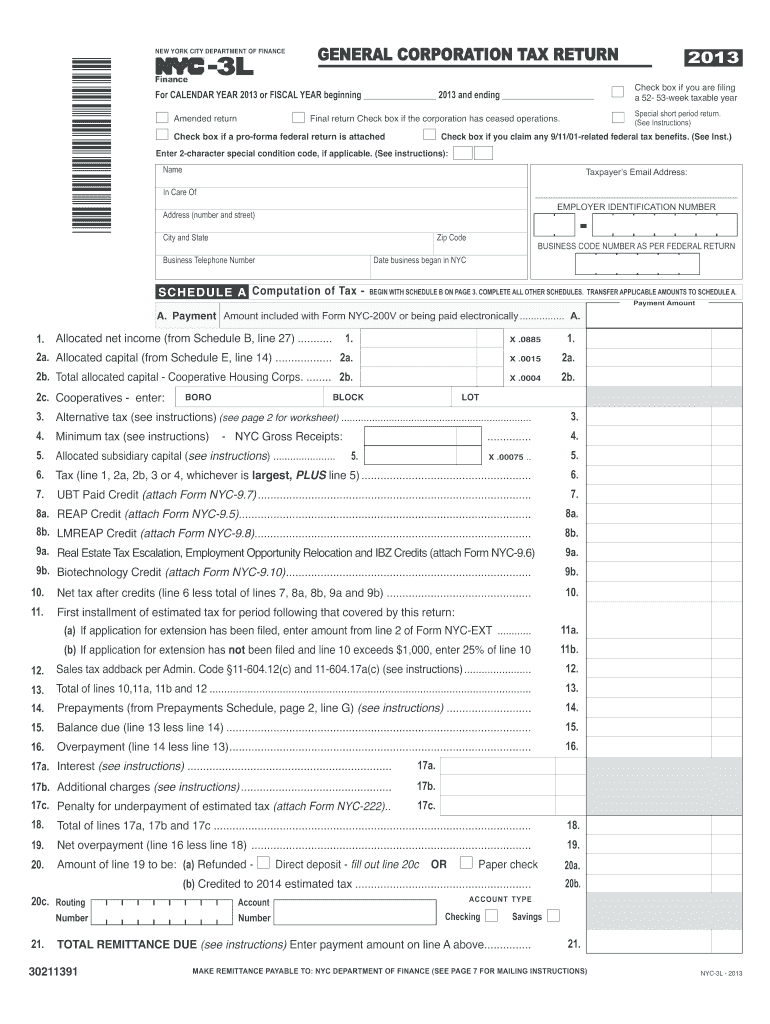

NYC DoF NYC-3L 2013 free printable template

Show details

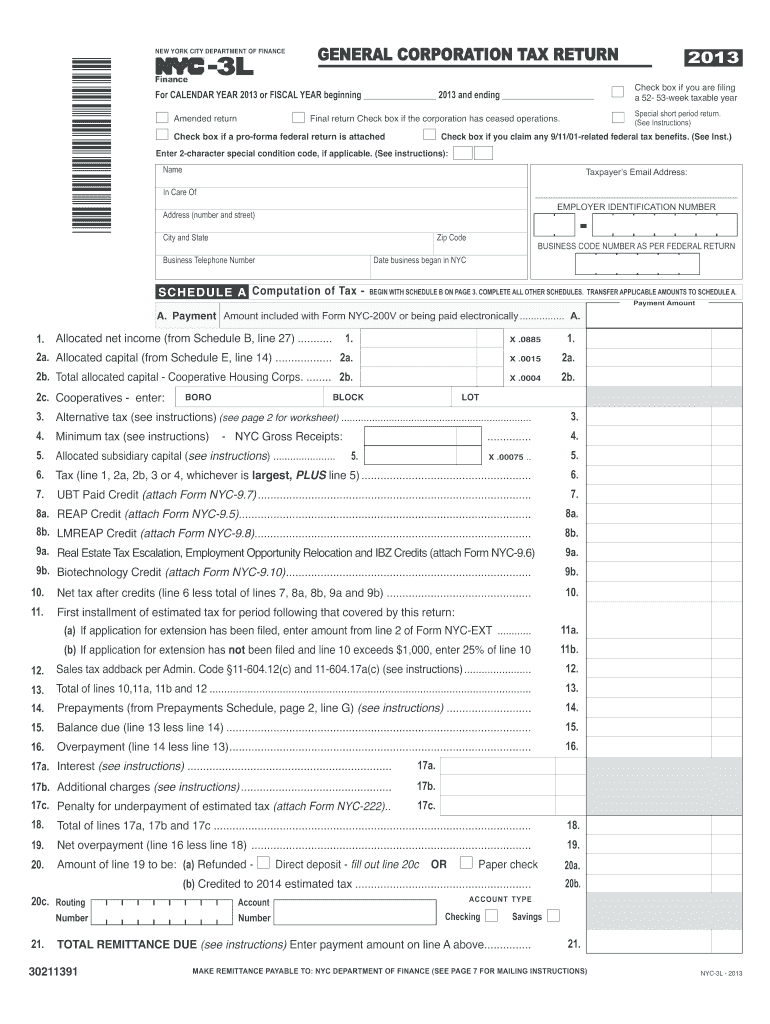

MAKE REMITTANCE PAYABLE TO NYC DEPARTMENT OF FINANCE SEE PAGE 7 FOR MAILING INSTRUCTIONS NYC-3L - 2013 form nyC-3L - 2013 namE SCHEdULE a - Continued Computation of tax - EIn 21a. Issuer s allocation percentage from Schedule E line 15. 30211391 -3L GENERAL CORPORATION TAX RETURN nEw york CIty dEpartmEnt of fInanCE For CALENDAR YEAR 2013 or FISCAL YEAR beginning 2013 and ending n Amended return Final return Check box if the corporation has ceased operations. Check box if a pro-forma federal...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax tips for new form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax tips for new form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax tips for new online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax tips for new. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

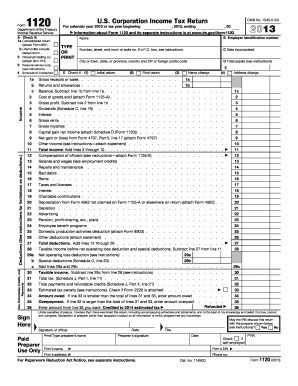

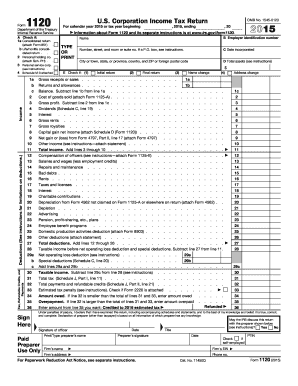

NYC DoF NYC-3L Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax tips for new

How to fill out tax tips for new:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and receipts for deductions.

02

Determine your filing status (single, married filing jointly, etc.) and gather any relevant information for your status.

03

Calculate your income by adding up all sources of income, including wages, self-employment income, and investment income.

04

Determine your deductions and credits by reviewing the eligible expenses such as education expenses, medical expenses, or mortgage interest payments.

05

Complete the appropriate tax forms such as Form 1040, 1040A, or 1040EZ, depending on your situation.

06

Double-check all the information entered on the forms for accuracy and completeness.

07

Sign and date the tax forms before submitting them to the appropriate tax authority, either electronically or by mail.

Who needs tax tips for new:

01

Individuals who have recently entered the workforce and are unfamiliar with the tax filing process.

02

New small business owners who need guidance on how to report and deduct business expenses on their tax returns.

03

Newly married couples who need to understand how their filing status and marital status affect their tax obligations.

04

Recent homeowners who need assistance in understanding the mortgage interest deduction and other homeownership tax benefits.

05

Individuals with significant investment income who want to ensure they are reporting it correctly and taking advantage of any applicable tax breaks.

06

Students or parents of students who are dealing with education-related expenses and want to claim any available education tax credits or deductions.

07

Freelancers or self-employed individuals who need assistance in navigating the complexities of reporting self-employment income and deductible business expenses on their tax returns.

Instructions and Help about tax tips for new

Fill form : Try Risk Free

People Also Ask about tax tips for new

How do I avoid New York City taxes?

Do taxes depend on where you live or where you work?

Do you pay New York City tax if you work in the city?

How do I get the most out of self-employment tax?

Is New York City tax based on where you live or work?

What are the taxes for freelancers in NYC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax tips for new?

Here are some tax tips for newcomers:

1. Determine your residency status: As a newcomer, it's important to determine your tax residency status in your new country. This will dictate which taxes you are obligated to pay and what tax benefits or refunds you may be eligible for.

2. Learn about the local tax system: Take the time to understand the tax laws and regulations in your new country. Each jurisdiction has its own tax rules, rates, and deadlines, so familiarizing yourself will help ensure compliance and avoid any penalties.

3. Keep track of important documents: Maintain a file or folder to organize important tax-related documents such as your employment contract, pay stubs, rental agreements, bank statements, and any other income or expense receipts. These documents will be necessary when filing your tax returns.

4. Understand tax deductions and credits: Research and understand the available deductions and tax credits in your new country. These can vary depending on factors such as employment status, family situation, education expenses, and more. By taking advantage of applicable deductions and credits, you can potentially reduce your tax liability.

5. Consult with a tax professional: If you are unsure about the tax laws or need assistance with complex tax matters, consider consulting with a tax professional who specializes in handling tax issues for newcomers. They can provide personalized guidance based on your specific situation and help you maximize your tax benefits.

6. File your tax returns on time: Familiarize yourself with the tax filing deadlines in your new country and make sure to file your tax returns on or before the due date. Failing to do so can result in penalties and unnecessary complications.

7. Understand dual tax obligations: If you have tax obligations in both your home country and your new country, it's crucial to understand any tax treaties or agreements that may alleviate double taxation. Seek advice from tax professionals who are familiar with international tax matters.

Remember, tax laws and regulations can be complex, so it's always prudent to seek professional advice to ensure you comply with your tax obligations accurately and efficiently.

How to fill out tax tips for new?

Filing taxes can seem overwhelming, especially if you are new to the process. Here are some tips to help you navigate through the tax filing process:

1. Gather all necessary documents: Collect all relevant documents such as W-2 forms from your employer, 1099 forms for any other income, receipts for deductible expenses, and any other forms required for your specific tax situation.

2. Determine your filing status: Your filing status (e.g., single, married filing jointly, head of household) will affect your tax rates and deductions. Make sure to choose the correct status before filling out your tax forms.

3. Choose the right tax form: The IRS provides different tax forms depending on your income level and sources of income. The most common forms are 1040, 1040A, and 1040EZ. Use the appropriate form based on your situation or consult a tax professional for help.

4. Fill in personal information: Provide your personal details, including your name, Social Security Number (SSN), address, and any other requested information. Ensure accuracy to avoid delays or errors.

5. Report your income: Accurately report all sources of income for the tax year. Include wage and salary income (reported on your W-2), self-employment income, rental income, investment income, and any other taxable income.

6. Deductions and credits: Determine if you are eligible for any deductions or credits. Common deductions include student loan interest, mortgage interest, medical expenses, and charitable contributions. Credits such as the Child Tax Credit or the Earned Income Credit can also help reduce your tax liability. Consult IRS publications or a tax professional to identify potential deductions and credits that apply to your situation.

7. Use electronic filing: Consider filing your taxes electronically. This method is generally faster, more accurate, and ensures you receive any potential refund more quickly. Many tax software programs are user-friendly and will guide you through each step.

8. Review and double-check: Before submitting your tax return, carefully review all the information you've entered. Ensure accuracy, especially when it comes to numbers and calculations. Double-check for any potential errors or omissions.

9. Sign and submit your tax return: If you are filing electronically, follow the directions on the software program to sign and submit your tax return securely. If filing a paper return, make sure to sign and date it before mailing it to the appropriate tax office.

10. Keep copies and records: After filing your tax return, keep copies of all documentation, including a copy of your tax return itself, for at least three years. This is important for future reference or in case of any future tax inquiries.

Remember, these tips are meant to provide general guidance. If you have complex tax situations or uncertainty, it's always advisable to consult a tax professional or certified public accountant (CPA) for personalized assistance.

What is the purpose of tax tips for new?

Tax tips for new individuals or taxpayers are designed to provide guidance and advice on how to effectively manage one's taxes. The purpose of these tips is to:

1. Increase awareness: Many people may not be aware of all the tax deductions and credits that they are eligible for. Tax tips help educate individuals about potential tax benefits and exemptions they may otherwise overlook.

2. Minimize tax liability: The primary goal of tax tips is to help individuals minimize their tax liability legally. Tips often provide guidance on maximizing deductions, taking advantage of tax credits, and utilizing tax-efficient strategies to lower the amount of tax owed.

3. Simplify tax filing: Tax laws can be complex and overwhelming, especially for new taxpayers. Tips aim to simplify the tax filing process by breaking down complex concepts and explaining them in easily understandable terms.

4. Avoid penalties and errors: Tips also help individuals avoid common tax errors and penalties. By providing advice on compliant tax practices, individuals can better navigate the tax system without making mistakes that could lead to penalties or audits.

5. Improve financial planning: Tax tips can also assist individuals in better financial planning. By understanding the tax implications of certain decisions, such as investments or major life events, individuals can plan their finances in a way that minimizes tax consequences.

Overall, tax tips for new individuals serve to empower taxpayers with knowledge and strategies that can help them make informed decisions and effectively manage their taxes.

What information must be reported on tax tips for new?

Tax tips for new businesses typically include the following information:

1. Entity type: New businesses must understand the different entity types such as sole proprietorship, partnership, limited liability company (LLC), or corporation, as each has different tax implications.

2. Filing requirements: Businesses must know their tax filing obligations. This includes understanding whether they need to file as a separate business entity or report their business income on their personal tax return.

3. Employer Identification Number (EIN): New businesses that plan to hire employees need to obtain an EIN from the Internal Revenue Service (IRS). This number is used for tax purposes and is necessary for reporting employee wages and taxes withheld.

4. Tax deductions: Businesses can take advantage of various tax deductions and credits. These may include deductions for startup costs, business-related travel expenses, office supplies, equipment purchases, and certain business-related education expenses.

5. Estimated tax payments: New businesses are often required to make estimated tax payments throughout the year to avoid penalties and interest. Knowing how to calculate these payments and when they are due is essential.

6. Recordkeeping: Keeping accurate and organized records is crucial for tax purposes. New businesses should maintain records of income, expenses, business-related receipts, and other relevant financial documents.

7. State and local taxes: In addition to federal taxes, businesses need to be aware of their state and local tax obligations. These may include sales tax, property tax, and local business license fees.

8. Quarterly tax reporting: Depending on the entity type and the size of business income, businesses may need to file quarterly tax returns. Understanding the requirements and due dates for these filings is essential.

9. Tax professionals: It's advisable to consult with a tax professional or accountant who specializes in small business taxes. They can help navigate complex tax regulations and ensure compliance while maximizing available deductions.

10. Tax deadlines: New businesses should be aware of important tax deadlines, including the due date for filing income tax returns, making estimated tax payments, and providing tax-related forms to employees and contractors.

These tax tips provide a starting point for new businesses to understand their tax obligations. However, it is important to consult with a tax professional or accountant for personalized advice based on your specific business circumstances.

When is the deadline to file tax tips for new in 2023?

The deadline to file tax returns for the year 2023 varies depending on the country you reside in. In the United States, the tax filing deadline is typically April 15th of each year. However, it is important to note that tax laws and deadlines may change, so it is recommended to consult with a tax professional or check with the relevant tax authority closer to the time for the most accurate and up-to-date information.

What is the penalty for the late filing of tax tips for new?

The penalty for late filing of tax tips can vary depending on the jurisdiction and specific circumstances. Generally, if you fail to file your tax return by the due date, you may be subject to penalties.

In the United States, for example, the penalty for late filing is usually a percentage of the unpaid taxes due. This penalty can range from 5% to 25% of the unpaid tax amount, depending on how late the return is filed. Additionally, if you don't pay your taxes on time, you may also be subject to a separate penalty for late payment, which is generally 0.5% per month of the unpaid tax amount.

It's important to note that these penalties can accumulate over time, making it even more costly not to file or pay your taxes on time. It's always advisable to consult with a tax professional or the tax authority in your jurisdiction to understand the specific penalty structure that applies to your situation.

Who is required to file tax tips for new?

Individuals who have earned income or received certain types of income are generally required to file tax returns. Some examples include:

1. Individuals whose income exceeds the minimum threshold set by the tax authorities.

2. Self-employed individuals, including freelancers, independent contractors, and small business owners.

3. Individuals who have received income from dividends, interest, capital gains, or rental properties.

4. Individuals who have received income from pensions, annuities, or Social Security.

5. Individuals who received unemployment compensation during the tax year.

6. Non-resident aliens with income from U.S. sources.

7. Individuals who received a distribution from a Health Savings Account (HSA), Archer MSA (Medical Savings Account), or a Medicare Advantage MSA.

8. Individuals who owe taxes due to early distributions from retirement accounts or other penalty-based situations.

9. Individuals who qualify for certain tax credits or deductions.

It is important to note that filing requirements can vary based on factors such as age, filing status, and type of income. It is recommended to consult with a tax professional or refer to the official guidelines provided by the tax authorities to determine specific filing requirements.

How do I edit tax tips for new straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing tax tips for new right away.

Can I edit tax tips for new on an Android device?

You can make any changes to PDF files, such as tax tips for new, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out tax tips for new on an Android device?

Use the pdfFiller Android app to finish your tax tips for new and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your tax tips for new online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.