Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is st 100 form?

There is no specific or widely known form named "ST 100 form." Without further context or information, it is difficult to determine what the form may refer to. It is possible that "ST 100" may represent a code or reference used within a specific organization or industry, but without more details, it is not possible to provide a definitive answer.

Who is required to file st 100 form?

The ST-100 form is typically filled out by businesses in the state of New York that are required to collect and remit sales tax. This includes retailers, wholesalers, manufacturers, service providers, and other businesses that engage in taxable activities.

How to fill out st 100 form?

To fill out ST-100 form, you can follow these steps:

1. Obtain the ST-100 form: You can download the form from the website of the tax department of your state. It may also be available at local tax offices or can be requested by mail.

2. Enter your basic information: Start by providing your full legal name, address, and contact details. If you are filing as a business entity, provide the business name and details as well.

3. Specify the tax period: Indicate the tax period to which the form applies, such as the month, quarter, or year.

4. Provide your sales information: Report your gross sales or receipts during the tax period. This includes sales of taxable goods or services. Separate taxable sales from nontaxable sales.

5. Calculate your tax liability: Once you have reported your sales, calculate the tax amount owed. Multiply the taxable sales by the applicable sales tax rate to determine the tax liability.

6. Deductions, exemptions, and credits: If applicable, report any deductions, exemptions, or credits that apply to your business or situation. This might include exempt sales or certain business expenses that can be deducted.

7. Complete additional sections: The ST-100 form may have additional sections that require specific information based on your business activity or state requirements. Make sure to fill out all relevant sections thoroughly.

8. Sign and date the form: Sign and date the completed form to certify its accuracy and completeness.

9. Retain a copy: Make a copy of the filled out ST-100 form for your records before submitting it.

10. Submit the form: Follow the instructions provided on the form or by your state's tax department to submit the form electronically or by mail. Verify the preferred method for submission.

Note: While these steps provide a general guideline, it is essential to review the specific instructions provided with the ST-100 form from your state's tax department. The form and instructions can vary between states, so always consult the official guidelines to ensure accurate completion.

What is the purpose of st 100 form?

The purpose of the ST-100 form varies depending on the jurisdiction, but in general, it is a sales tax exemption certificate or resale certificate that allows individuals or businesses to make purchases without paying sales tax. The form is typically used by resellers who purchase goods for resale, rather than for personal use. By providing this form to the seller, the purchaser certifies that the goods being purchased will be resold in the normal course of business and therefore should not be subject to sales tax.

What information must be reported on st 100 form?

The ST-100 form (Sales Tax Return) is used by businesses to report their sales and use tax liability. The specific information that is typically required to be reported on the ST-100 form may vary depending on the state or jurisdiction, but it generally includes the following:

1. Business information: The name, address, and contact details of the business filing the return.

2. Reporting period: The start and end date for the reporting period being filed (e.g., monthly, quarterly, or annual).

3. Gross sales: The total amount of sales made during the reporting period, including both taxable and exempt sales.

4. Exempt sales: If applicable, the total amount of exempt sales made during the reporting period that are not subject to sales tax.

5. Taxable sales: The total amount of taxable sales made during the reporting period that are subject to sales tax.

6. Discounts: Any sales discounts provided to customers during the reporting period that reduce the taxable sales amount.

7. Exemptions and exclusions: Any specific exemptions or exclusions allowed by the state, such as sales of certain goods or services that are not subject to sales tax.

8. Tax collected: The total amount of sales tax collected from customers during the reporting period on taxable sales.

9. Prepayments and credits: Any prepayments or credits received by the business, such as sales tax credits for tax paid on purchases, or any overpayments made in previous reporting periods.

10. Tax due or refund: The calculation of sales tax due or refundable, taking into account the tax collected and any applicable exemptions, credits, or prepayments.

11. Payment details: The amount of tax due to be remitted to the state, if applicable, along with the payment method and any supporting payment documentation.

It is important to note that the specific requirements and information to be reported on the ST-100 form can vary depending on the state or jurisdiction where the business is registered and operates. Businesses should consult the instructions and guidelines provided by their respective state's tax authority for accurate and up-to-date reporting requirements.

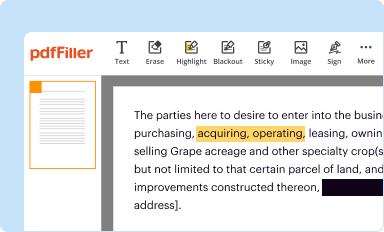

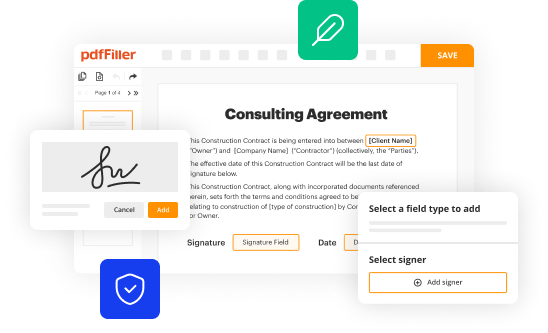

How can I modify NY DTF ST-100 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your NY DTF ST-100 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute NY DTF ST-100 online?

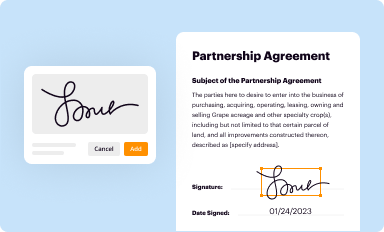

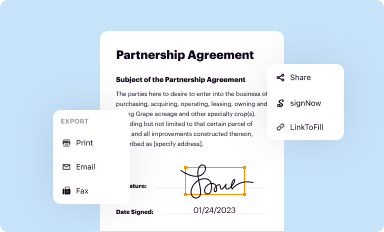

pdfFiller has made it simple to fill out and eSign NY DTF ST-100. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit NY DTF ST-100 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your NY DTF ST-100 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is NY DTF ST-100?

NY DTF ST-100 is a New York State tax form used to report and remit sales tax collected by businesses.

Who is required to file NY DTF ST-100?

Businesses in New York that collect sales tax from customers are required to file NY DTF ST-100.

How to fill out NY DTF ST-100?

To fill out NY DTF ST-100, you need to provide information such as your business details, total sales, total taxable sales, and the amount of sales tax collected.

What is the purpose of NY DTF ST-100?

The purpose of NY DTF ST-100 is to report sales tax collected and to remit that tax to the New York State Department of Taxation and Finance.

What information must be reported on NY DTF ST-100?

The information that must be reported includes the business name, address, sales tax identification number, total gross sales, total sales tax collected, and applicable deductions.