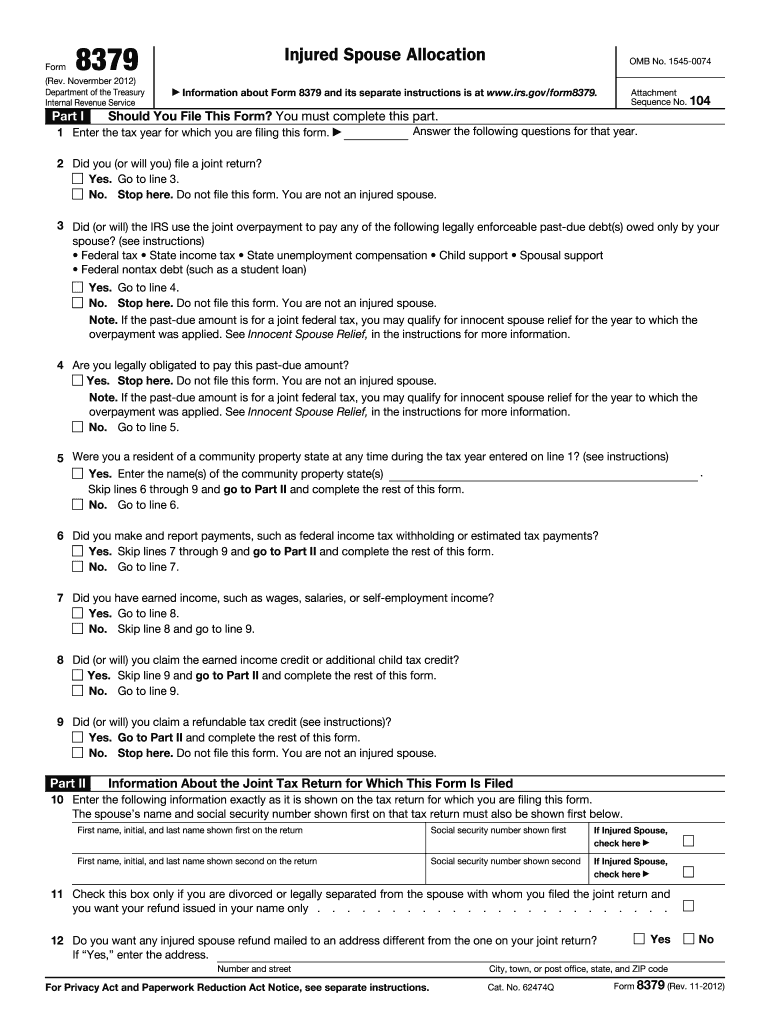

What is the 8379 form for?

The Injured Spouse Allocation is a document that the injured spouse must file to reclaim overpaid taxes. An offset of overpaid taxes may be returned to the injured spouse after filing the 8379 form to share the joint refund. Not all debts or obligations may be on this paper, so contact the IRS for more details if needed.

Who needs the 8379 form?

Form 8379 (Injured Spouse Allocation) is for people who have the legal status of Injured (negatively impacted) Spouse. The first page of the template includes questions that help you determine if you are an injured spouse or not.

Married couples share responsibility for their tax obligations. If one spouse falls behind on alimony, federal or state taxes, or has other past-due obligations, the Department of Treasury can take the taxpayer's refund to cover these past-due debts from both spouses.

What information do you need to file the 8379 form?

To complete IRS Form 8379, you need information about the joint return (names and social security numbers of spouses) and allocation between spouses of items on the joint return.

How do I fill out the 8379 Form in 2013?

To fill out the sample, you must provide the following information:

- The tax year of filing

- Have you ever filed a joint refund

- Did IRS use overpayments for paying legally enforceable debts

- Obligations of payments

- Community resident status of an applicant

- Did the applicant have reported payments

- Incomes (from salaries, wages, or self-employment)

- Credit history

Follow the instructions below to accelerate filling out Form 8379:

- Click Get Form to open a template in pdfFiller, our online editor.

- Complete the survey to ensure you are eligible for filing.

- Fill out Part II, including data about the tax refund, which is found in the tax declaration. Insert the name and social security number of each spouse. The one who is injured must fill the checkbox.

- Mark the checkbox on line 11 only if both spouses were issued a refund. Enter names for each spouse who will receive a refund in all other cases.

- In Part III, specify allocations between spouses.

- Complete the document by signing (using the Sign tool) and dating.

- Select Done to apply changes to the record and close the editor.

- Save your document, print it out, or send it by email.

Do other forms accompany the 8379?

Injured Spouse Allocation is accompanied by 1040-X and with a standard tax payment declaration.

When is Form 8379 due?

Submit the document as soon as you learn your share of overpayment was or will be applied to cover your spouse's past-due obligations. You have three years until the original refund will expire or within two years from when the last payment was made.

Processing forms may take 8 to 14 weeks, depending on the filing type (electronically filed documents are processed much faster).

Where do I send the 8379 Form?

Send the completed document to the Internal Revenue Service Center for the region where you live (your mailing address) when submitting it with your joint return, by itself after filing a joint return electronically, or with an amended or other subsequent return. If you file a completed document by itself after filing your joint return on paper, send it to the same Internal Revenue Service Center.