Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

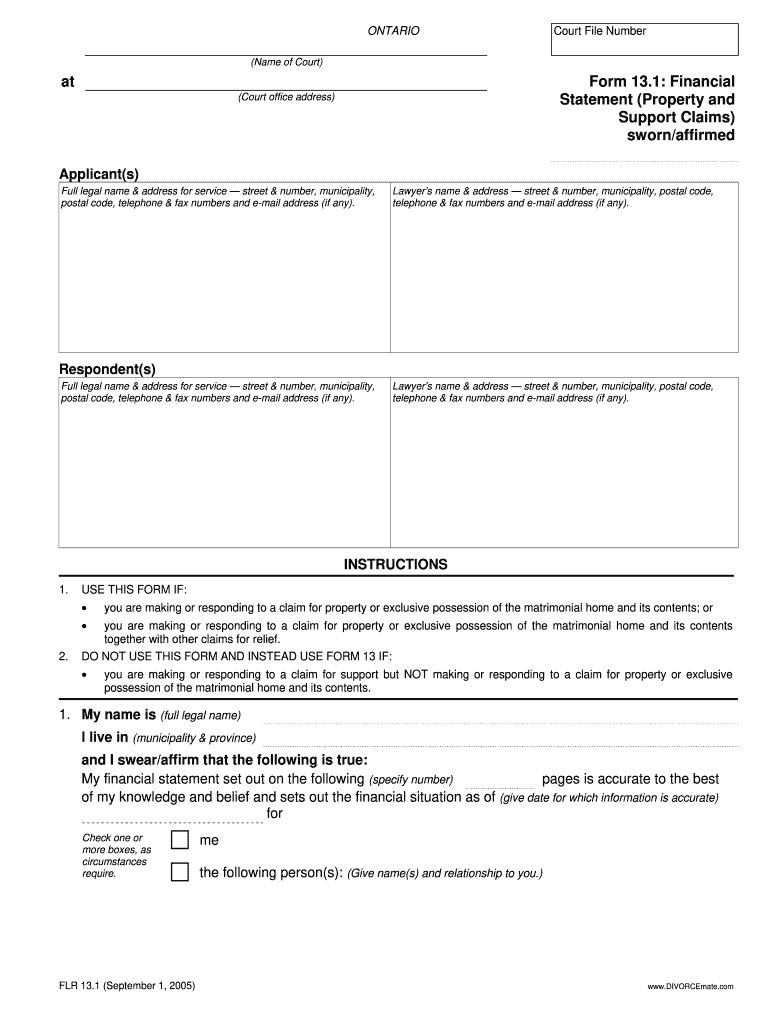

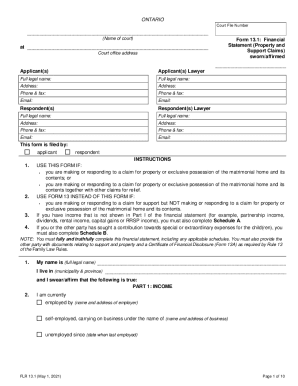

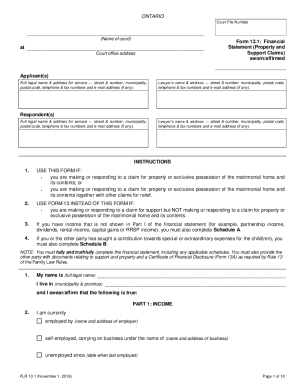

Who is required to file 13 1 financial statement?

The specific form 13 1 financial statement is not recognized or commonly referred to. It is possible that you are referring to another type of financial statement required by a particular regulatory body or for a specific purpose.

To provide a more accurate answer, please provide more information or clarify your query.

How to fill out 13 1 financial statement?

To fill out a 13 1 financial statement, you will need to follow these steps:

1. Collect all of your financial documents such as bank statements, tax returns, pay stubs, and investment statements.

2. Start by entering your personal information at the top of the form, including your name, address, and Social Security number.

3. Fill out the income section of the form. Include all sources of income such as wages, self-employment income, social security benefits, and rental income. Be sure to include any other types of income you receive.

4. Deduct any applicable expenses from your income. These may include rent or mortgage payments, utilities, car payments, insurance, and medical expenses.

5. Calculate your net monthly income by subtracting your total expenses from your total income.

6. Move on to the assets section of the form. List all of your assets, including bank accounts, investment accounts, real estate, vehicles, and personal belongings. Include the estimated value of each asset.

7. Deduct any applicable exemptions for each asset. Exemptions may include a homestead exemption for your primary residence or vehicle exemptions.

8. Calculate your total assets by subtracting the exemptions from the value of each asset.

9. Move on to the liabilities section of the form. List all of your debts, such as credit card balances, medical bills, student loans, and mortgages.

10. Calculate your total liabilities by adding up the balances of all of your debts.

11. Subtract your total liabilities from your total assets to calculate your net worth.

12. Finally, sign and date the form to certify that the information you provided is true and accurate to the best of your knowledge.

It is important to note that the specific requirements for filling out a 13 1 financial statement may vary depending on the jurisdiction where you are filing. Consulting with a bankruptcy attorney or expert may be helpful to ensure that you complete the form correctly and comply with any local regulations.

What is the purpose of 13 1 financial statement?

The purpose of the 13 1 financial statement, also known as Form 13F, is to provide transparency about the holdings of institutional investment managers with assets over a certain threshold. It requires these managers to disclose their holdings of securities, including stocks, options, and convertible bonds, on a quarterly basis. The information collected in the Form 13F is made public and helps investors, regulators, and the general public to assess the investment strategies and market positions of these institutional managers. It allows for greater transparency and understanding of the activities and holdings of large institutional investors.

What information must be reported on 13 1 financial statement?

A 13 1 financial statement, also known as the Statement of Financial Position or Balance Sheet, typically includes the following information:

1. Assets: This section reports the company's resources owned or controlled, such as cash, accounts receivable, inventory, property, equipment, and investments.

2. Liabilities: This section reports the company's outstanding debts or obligations, including accounts payable, loans, accrued expenses, and deferred revenue.

3. Equity: This section reports the ownership interest in the company, including common stock, retained earnings, and additional paid-in capital.

4. Financial Ratios: Various financial ratios, such as current ratio, debt-to-equity ratio, or return on equity, might be included to provide insights into the company's financial health and performance.

Additionally, the financial statements may include footnotes providing additional details and explanations about the items reported on the balance sheet. It is important to note that the specific information presented may vary depending on the reporting standards followed by the company or the regulatory requirements of the jurisdiction it operates in.

When is the deadline to file 13 1 financial statement in 2023?

The deadline to file a 13 1 financial statement in 2023 can vary depending on the specific jurisdiction and applicable regulations. Therefore, it is recommended to check with the relevant authorities or a legal professional to determine the exact deadline for filing a 13 1 financial statement in your specific case.

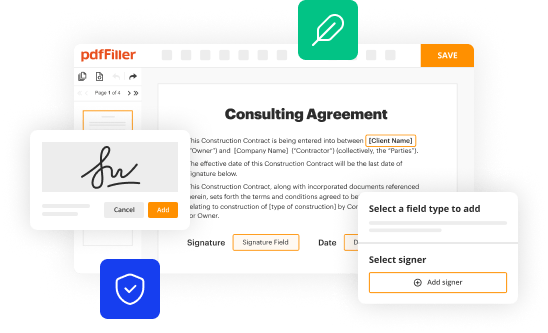

How can I edit 13 1 financial statement from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your form 13 1 into a dynamic fillable form that can be managed and signed using any internet-connected device.

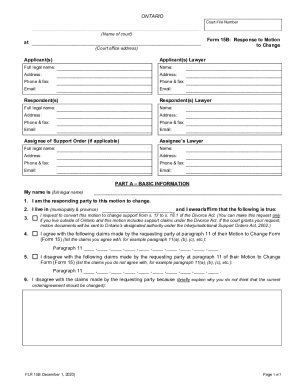

How can I send form 13 1 financial statement for eSignature?

When you're ready to share your form 13 ontario, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an eSignature for the form 13 financial statement in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your ontario form 13 1 financial statement and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.