KS DoR CR-16 2013 free printable template

Show details

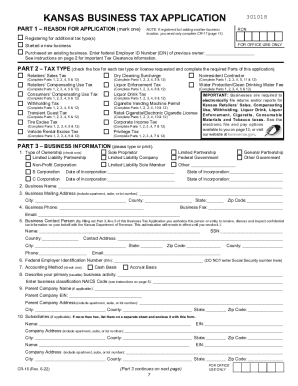

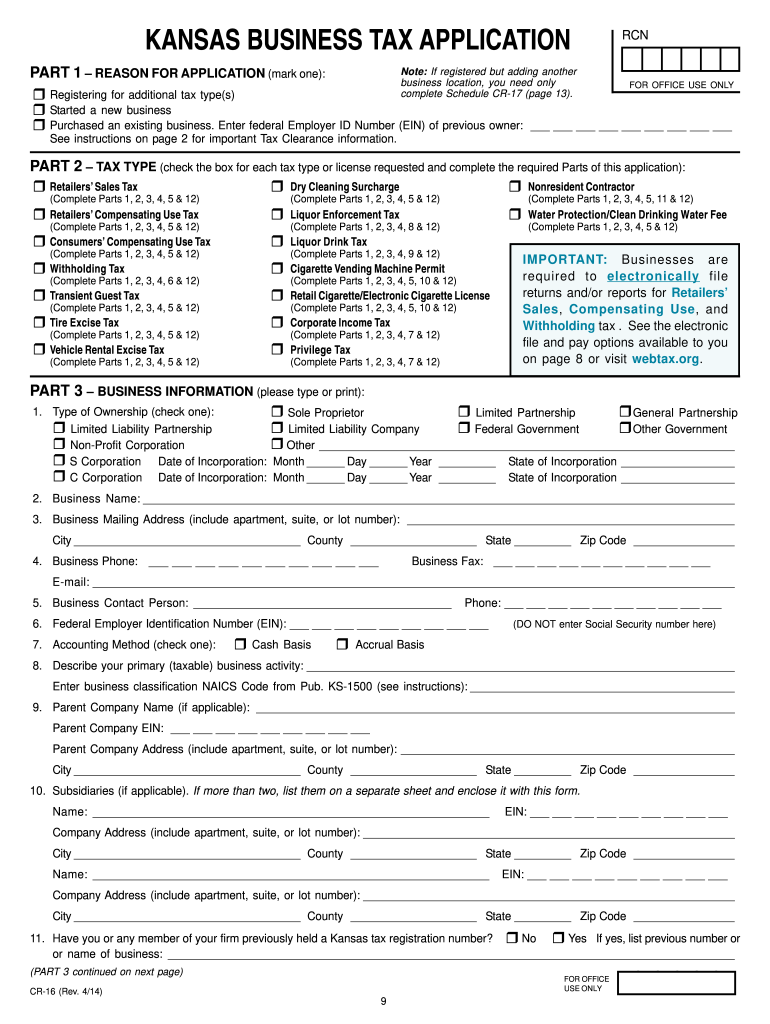

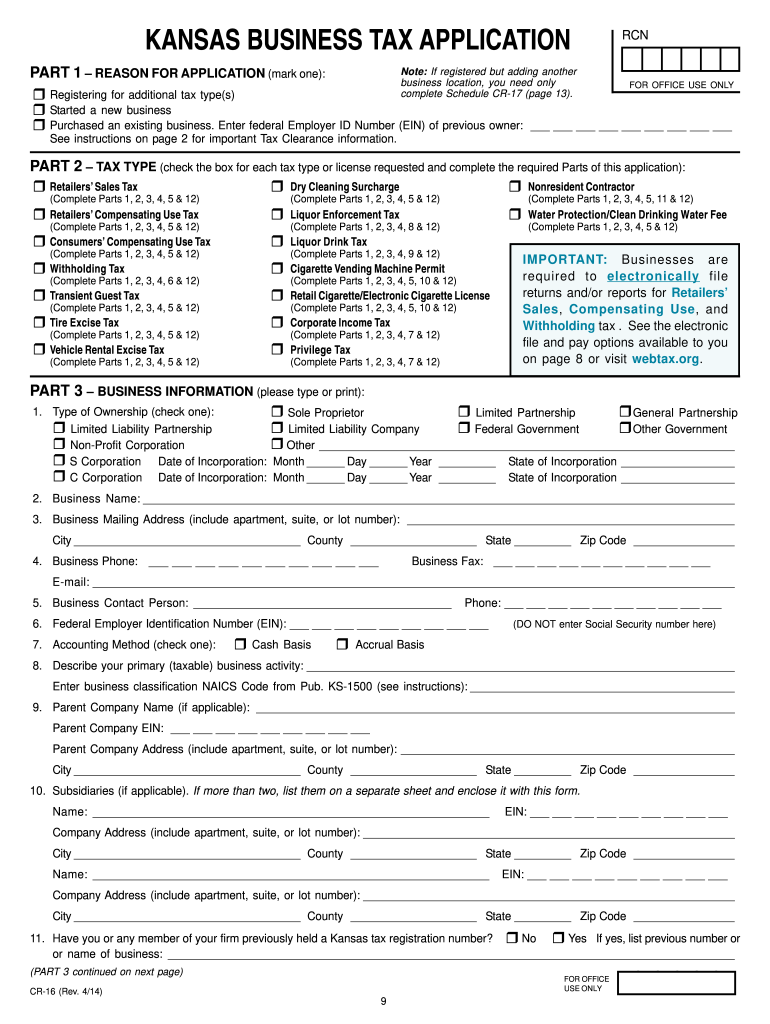

KS-1500 see instructions 9. Parent Company Name if applicable 10. Subsidiaries if applicable. If more than two list them on a separate sheet and enclose it with this form. Name EIN Company Address include apartment suite or lot number 11. Have you or any member of your firm previously held a Kansas tax registration number No Yes If yes list previous number or or name of business PART 3 continued on next page FOR OFFICE USE ONLY CR-16 Rev. 4/14 ENTER YOUR EIN OR 12. Have you or any member...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your cr 16 2013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cr 16 2013 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cr 16 2013 form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cr 16 2013 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

KS DoR CR-16 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out cr 16 2013 form

01

To fill out the CR 16 2013 form, start by obtaining a copy of the form from the appropriate authority. This form is typically used for certain official purposes, such as reporting income or declaring taxes.

02

Once you have the form, carefully read all the instructions provided. It is important to understand the requirements and guidelines mentioned in the instructions before filling out the form.

03

The form may require you to provide various details such as personal information, financial information, and other relevant details. Make sure to gather all the necessary information and organize it accordingly.

04

Begin by filling out the relevant sections of the form accurately and legibly. It is essential to provide the correct information to avoid any potential complications or issues.

05

Double-check the form after completing each section to ensure accuracy. This will help to minimize errors and prevent potential delays or rejections.

06

If you encounter any terms or sections that you are unsure about, seek assistance from a professional or refer to the instructions provided. It is crucial to fill out the form correctly to comply with legal requirements.

07

Once you have completed filling out the form, review it thoroughly to ensure that all the necessary fields have been filled and the information provided is correct.

Who needs the CR 16 2013 form?

01

Individuals who are required to report their income or declare their taxes may need to fill out the CR 16 2013 form. This form is commonly used for tax-related purposes and is often required by the tax authorities.

02

Self-employed individuals, freelancers, and small business owners may need to fill out the CR 16 2013 form to report their business income or expenses.

03

Anyone who has received income from sources such as investments, rental properties, or royalties may also need to fill out this form to accurately report their earnings.

04

Those who have received a specific request or notification from the tax authorities to fill out the CR 16 2013 form should also comply with the request and complete the form accordingly.

05

It is important to note that the requirements for filling out this form may vary based on the jurisdiction and specific regulations. It is recommended to consult with a tax professional or seek guidance from the relevant tax authorities to determine if this particular form is applicable to your situation.

Fill form : Try Risk Free

People Also Ask about cr 16 2013 form

How do I get a sales tax certificate in Kansas?

How do I get a Kansas tax ID number?

How much does it cost to get a tax ID number in Kansas?

How do you set up sales tax?

How much does it cost to get an EIN in Kansas?

Does Kansas require resale certificate?

How do I get a Kansas withholding tax account?

Does Kansas have state withholding tax?

Do I need to collect sales tax in Kansas?

How do I get a tax ID for my business in Kansas?

How do I get a Kansas tax account number?

How does sales tax work in Kansas?

Do I need a Kansas tax ID?

Do I need to register for sales tax in Kansas?

How do I get a tax ID number in Kansas?

How do I pay withholding tax in Kansas?

How do I set up sales tax in Kansas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cr 16 form?

CR 16 form is a document that is used for reporting financial information and related details.

Who is required to file cr 16 form?

Certain individuals and businesses are required to file CR 16 form, such as taxpayers with specific financial transactions or income.

How to fill out cr 16 form?

To fill out CR 16 form, you need to provide accurate financial information as required by the form. It may include details about income, expenses, investments, and other relevant information.

What is the purpose of cr 16 form?

The purpose of CR 16 form is to gather financial information for taxation or regulatory purposes, ensuring compliance with applicable laws and regulations.

What information must be reported on cr 16 form?

The information that must be reported on CR 16 form may vary depending on the specific requirements of the form, but typically it includes details about income, expenses, assets, liabilities, and other financial matters.

When is the deadline to file cr 16 form in 2023?

The deadline to file CR 16 form in 2023 may vary based on specific regulations and jurisdictions. It is advisable to consult the relevant authority or visit their official website for accurate information on the deadline.

What is the penalty for the late filing of cr 16 form?

The penalty for the late filing of CR 16 form may vary depending on applicable laws and regulations. It is recommended to refer to the guidelines provided by the respective authority for accurate information on penalties.

How can I send cr 16 2013 form for eSignature?

When you're ready to share your cr 16 2013 form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find cr 16 2013 form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the cr 16 2013 form. Open it immediately and start altering it with sophisticated capabilities.

How do I complete cr 16 2013 form on an Android device?

Complete cr 16 2013 form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your cr 16 2013 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.