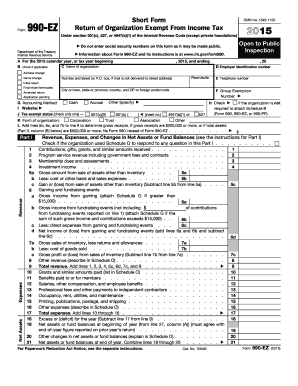

What is form 990 EZ?

The IRS 990 EZ is a shortened version of the annual reporting return that many income-tax-free organizations (section 501a), section 527 political organizations, and non-exempt charitable trusts file with the IRS. This declaration gives the IRS an overview of the organization's governance, activities, and financial activities. Some public members rely on form 990 EZ as their main or single source of information about a particular institution.

Who should file the form 990 EZ 2014?

Organizations with a tax-free status with gross receipts less than $200,000 and total assets less than $500,00 at the end of the year should file form 990 EZ. Institutions with their gross receipts and total assets equal to or exceeding the aforementioned amounts should report form 990 as an alternative.

What information do you need when you file form 990-ez?

To prepare the 990 EZ report, you should provide the following information:

- organization's details (name, address, telephone, EIN, organizational form)

- precise data on the earnings, costs, balances of funds, and any changes in net assets

- grants, salaries, and other benefits paid to/for the members

- investments, buildings, land, cash, and savings

- information about officers, trustees, directors, and key employees

Check the 990 EZ instructions provided by the IRS before completing the document. Please note that the annual returns of the reporting organizations are publically available, so do not write Social Security Numbers in form 990 ez.

How do you fill out the form 990 ez in 2015?

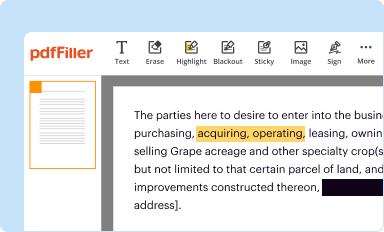

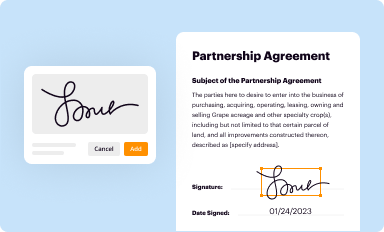

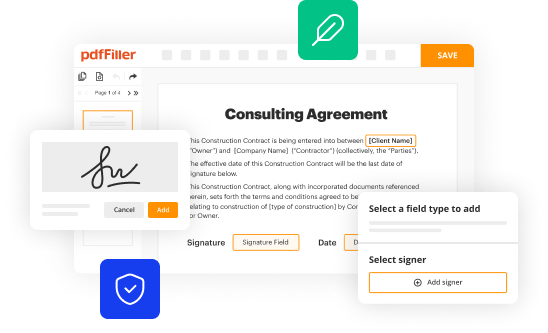

The Internal Revenue Service allows organizations to file their 990 ez reports electronically. You can fill out the document online with pdfFiller, a powerful editor with advanced file-sharing options. To complete the 990 ez online, follow the steps below:

- Upload the 990-ez template to the editor with the Get Form button.

- Click Start to begin with the first blank field.

- Use the editor's navigator and click Next to move to each required area.

- Ensure all the highlighted fields are completed according to the 990 ez instructions.

- Click Done to save changes and proceed with the file-sharing options.

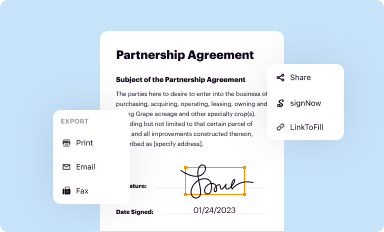

Once your 990 ez template is ready, you can email it, print it, or request a regular mail delivery to the IRS department right from the editor. Simply use the Send via USPS feature and file your report in a few clicks.

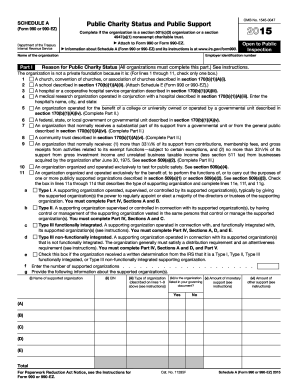

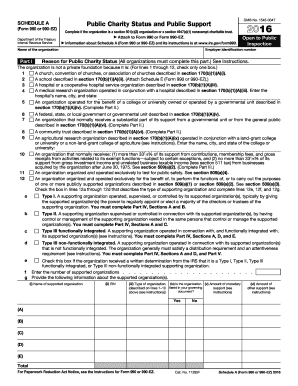

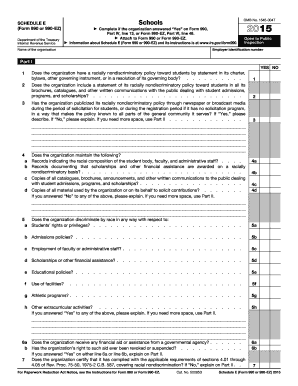

Is the form 990 EZ accompanied by other forms?

Depending on the type of tax-exempt organization, different Schedules can accompany the 990 EZ report. You may be required to fill out and provide several attachments to your report, such as Schedule A, B, C, E, G, L, N, or O. For more information, please check Part V (“Other Information”) of the form 990 ez instructions.

When is IRS 990 EZ due?

The end of the fiscal year determines the deadline by which organizations must submit form 990-EZ to the IRS. Institutions with income-tax-free status should prepare and send their 990-EZ by the 15th day of the 5th month after the organization's accounting period ends (May 15th for a calendar-year filer). If the due date falls on a Saturday, Sunday, or holiday, you should file on the next business day. Suppose the organization goes through a liquidation, dissolution, or termination process. In that case, it should file the return no later than the 15th day of the 5th month after it has been liquidated, dissolved, or terminated.

Where do I send the 990-EZ?

Organizations with tax-exempt status are required to forward the form 990 EZ to the IRS service center electronically or mail it at the following address:

Department of the Treasury

Internal Revenue Service

Center Ogden,

UT 84201-0027