MO DoR 4923 2008 free printable template

Show details

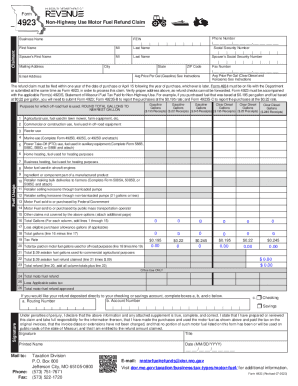

Reset Form MISSOURI DEPARTMENT OF REVENUE TAXATION BUREAU P.O. BOX 800 (573) 751-7671 JEFFERSON CITY, MISSOURI 65105-0800 FOR DO RUSE ONLY FORM Print Form 4923 (REV. 2-2008) Document No: Keyed Date:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your missouri dept of revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missouri dept of revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing missouri dept of revenue online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit missouri dept of revenue. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

MO DoR 4923 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out missouri dept of revenue

How to fill out Missouri Dept of Revenue:

01

Gather all necessary documents: Before starting the process, make sure you have all the required documents such as your Social Security number, proof of identification, proof of residency, income statements, and any relevant tax forms.

02

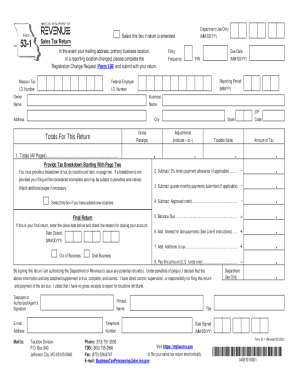

Determine the appropriate form: Missouri Dept of Revenue offers various forms depending on your specific purpose (e.g., income tax return, sales tax return, registration forms, etc.). Identify the correct form that corresponds to your needs.

03

Obtain the form: Visit the Missouri Dept of Revenue website (https://dor.mo.gov/forms/) or your local Department of Revenue office to download or request the appropriate form. Make sure you have the most up-to-date version.

04

Read the instructions: Carefully read the instructions included with the form. The instructions will provide step-by-step guidance on how to correctly fill out the form.

05

Provide accurate information: Fill out the form using accurate and current information. Double-check all fields, ensuring you have entered the correct information without any errors.

06

Attach supporting documents: If required, attach any supporting documents such as income statements, receipts, or other relevant paperwork. Make sure to follow the instructions provided on the form regarding the submission of supporting documents.

07

Sign and date the form: Once you have completed all the necessary sections of the form, sign and date it as instructed. Some forms may require additional signatures, such as a joint filer's signature for a joint tax return.

08

Make copies: Before submitting the form, make copies of all documents for your records. This will ensure that you have a copy of everything you submitted.

09

Submit the form: Once you have filled out the form correctly, attach any required supporting documents, and submit it according to the instructions provided. Depending on the form, you may submit it electronically, by mail, or in person at a designated location.

Who needs Missouri Dept of Revenue:

01

Missouri residents: Any individual who resides in the state of Missouri and meets the state's residency requirements will need to file various forms with the Missouri Dept of Revenue. This includes filing income tax returns, sales tax returns, property tax forms, and more.

02

Missouri businesses: All businesses operating in Missouri, whether it is a sole proprietorship, partnership, corporation, or LLC, are required to file certain forms with the Missouri Dept of Revenue. This includes sales tax returns, withholding tax returns, and other forms related to business activities and taxation.

03

Out-of-state taxpayers: Non-residents or individuals who earn income in Missouri but do not reside in the state may also have certain tax or registration requirements with the Missouri Dept of Revenue, depending on their specific circumstances. This may include filing non-resident income tax returns or applying for specific permits or licenses.

In conclusion, anyone residing in Missouri, operating a business within the state, or earning income in Missouri will likely need to fill out various forms with the Missouri Dept of Revenue to fulfill their tax and compliance obligations.

Fill form : Try Risk Free

People Also Ask about missouri dept of revenue

Does Missouri have a road toll refund?

How do I claim my Missouri sales tax back?

Who qualifies for Missouri gas tax refund?

How do I submit my Missouri gas tax refund?

How does Missouri gas tax refund work?

Can you get tax money back from gas?

Is the Missouri gas tax refundable?

Can you get money back for gas on taxes?

How does no mo gas tax app work?

Is Missouri getting a gas stimulus check?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is missouri dept of revenue?

The Missouri Department of Revenue is a government agency responsible for the administration of various tax laws, motor vehicle registration and licensing, driver licensing, and the issuance of identification cards in the state of Missouri. It collects taxes, such as sales tax, income tax, and property tax, and ensures compliance with tax regulations. The department also oversees the administration of various licensing and registration processes, including vehicle titles, driver's licenses, and ID cards.

Who is required to file missouri dept of revenue?

In Missouri, individuals are required to file the Missouri Department of Revenue if they meet certain criteria, which include:

1. Missouri residents with a gross income that exceeds the filing threshold set by the state. The filing threshold varies based on filing status, such as single, married filing jointly, head of household, etc.

2. Non-residents who earned income from sources within Missouri that is subject to state income tax.

3. Any individual who had Missouri state income tax withheld from their wages, even if their income does not exceed the filing threshold. This allows them to potentially receive a refund of the withheld amount.

4. Individuals who owe any other type of Missouri state tax, such as sales tax, use tax, etc., may also be required to file with the Missouri Department of Revenue.

It is important to note that these requirements may change, and it is recommended to review the Missouri Department of Revenue's official website or consult with a tax professional for the most accurate and up-to-date information.

What is the purpose of missouri dept of revenue?

The Missouri Department of Revenue (DOR) is a state government agency responsible for administering various tax and motor vehicle-related laws in the state of Missouri, United States. The primary purpose of the Missouri DOR is to collect state taxes, such as income tax, sales tax, and motor fuel taxes, to fund government services and programs. It also handles the issuance and renewal of driver's licenses, vehicle registrations, and titles, ensuring compliance with motor vehicle laws. The Department of Revenue also enforces laws related to the collection of child support payments and administers various tax credit programs. Overall, the purpose of the Missouri Department of Revenue is to ensure the efficient and accurate collection of taxes and provision of motor vehicle-related services in the state.

What information must be reported on missouri dept of revenue?

The Missouri Department of Revenue requires various information to be reported, depending on the specific type of report or form being filed. Some common information that may be required includes:

1. Personal information: Name, address, Social Security number or taxpayer identification number, date of birth, and contact information of the taxpayer or business entity.

2. Income information: Details of income earned, including wages, salaries, tips, rental income, self-employment income, capital gains, dividends, interest, pensions, and other sources of income.

3. Deductions and credits: Information on tax deductions and credits that the taxpayer may be eligible for, such as those related to educational expenses, home mortgage interest, medical expenses, child and dependent care expenses, and retirement contributions.

4. Business information: For business entities, information about the company or business, including the legal name, business address, employer identification number, date of formation, and details of business activities.

5. Sales and use tax information: Details of sales tax collected or used during the reporting period, including total sales, taxable sales, exempt sales, and any applicable deductions or credits.

6. Property information: Information about real estate property, including ownership details, property assessments, property tax payments, and any exemptions or credits claimed.

7. Vehicle information: Details of vehicles owned or leased, such as make, model, year, vehicle identification number (VIN), purchase price, and any applicable vehicle taxes or fees.

8. Withholding tax information: Information about employee withholding taxes, including wages paid, withholdings made, and any applicable credits or exemptions.

9. Other relevant information: Depending on the specific type of report or form being filed, other information may be required, such as information related to tax payments, tax credits, tax extensions, or tax refunds.

It is important to refer to the specific forms and instructions provided by the Missouri Department of Revenue to determine the accurate and detailed information required for reporting.

What is the penalty for the late filing of missouri dept of revenue?

The penalty for the late filing of Missouri Department of Revenue taxes depends on the specific tax type and circumstances. Generally, the penalty for late filing is 5% of the tax due per month, up to a maximum of 25% of the tax due. Additionally, interest will be charged on any tax owed from the due date until the date of payment. It's important to consult the Missouri Department of Revenue or a tax professional for specific information regarding penalties and deadlines.

How can I manage my missouri dept of revenue directly from Gmail?

missouri dept of revenue and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit missouri dept of revenue straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing missouri dept of revenue, you can start right away.

Can I edit missouri dept of revenue on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share missouri dept of revenue from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your missouri dept of revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.